TriCounty Lease Group

Update: by Sal 1-16-2012

Mr. Frederick, the consultant that shopped the lease to 17 gas companies is no longer accepting sign-up agreements. None of the companies were interested in land leases and it is not expected that any of them would be interested in the near future.

There are many reasons why the gas companies are not interested in leasing at this time.

We are on the outskirts of proven reserves. Natural gas prices are depressed. There is a glut of natural gas and lack of distribution. Gas companies are having difficulty keeping up with drilling on proven reserves and in some cases loosing leases because they can’t drill fast enough. It will likely take years for the situation to improve.

In the meantime, landmen may try to peddle leases. Do not sign a lease without getting legal advice and make sure that you know what you are doing. You could end up with a bad lease that will tie up your property for a very long time.

Gas Lease Agreement Update

5 posts

• Page 1 of 1

Re: Gas Lease Agreement Update

Small Update for the TriCounty Group June 28, 2010

From: Mr. Frederick

Status

We have assembled approximately 80 landowners with ~7000 acres and a possibility of 5000 more - S Wyoming, E Lackawanna and N Lucerne Counties

We have identified 8 potential gas company lease partners. Some will be more interested than others.

If you have any other neighbors or friends that may be interested, now is the time to have them contact us.

Lease Provisions

We have a comprehensive set of provisions to start. We have received little feedback to date, please express concerns you have so they can be incorporated into the requested lease.

Prospectivity

While mid to N Wyoming County is seeing advancing permitting and drilling activity, a good sign, the areas more south including S Wyoming, E Lackawanna and N Lucerne have geologic controversies Thermal maturity is what is in question, commonly known in the industry, it will take the drill bit and hard data to prove one way or the other. A risk in leasing is take some sure $$ now or wait and possible win more, but risk getting nothing. Early on geologic prospecting is an art, using limited existing information prospectivity is rated, then it moves to science as hard data reveals absolutes. Each company will have its own views and that will determine their level of interest.

We plan top put the offering on the table by the 3rd week of July. Please feel free to email with any questions.

From: Mr. Frederick

Status

We have assembled approximately 80 landowners with ~7000 acres and a possibility of 5000 more - S Wyoming, E Lackawanna and N Lucerne Counties

We have identified 8 potential gas company lease partners. Some will be more interested than others.

If you have any other neighbors or friends that may be interested, now is the time to have them contact us.

Lease Provisions

We have a comprehensive set of provisions to start. We have received little feedback to date, please express concerns you have so they can be incorporated into the requested lease.

Prospectivity

While mid to N Wyoming County is seeing advancing permitting and drilling activity, a good sign, the areas more south including S Wyoming, E Lackawanna and N Lucerne have geologic controversies Thermal maturity is what is in question, commonly known in the industry, it will take the drill bit and hard data to prove one way or the other. A risk in leasing is take some sure $$ now or wait and possible win more, but risk getting nothing. Early on geologic prospecting is an art, using limited existing information prospectivity is rated, then it moves to science as hard data reveals absolutes. Each company will have its own views and that will determine their level of interest.

We plan top put the offering on the table by the 3rd week of July. Please feel free to email with any questions.

- Admin

- Site Admin

- Posts: 22

- Joined: Mon Apr 05, 2004 2:03 pm

Re: Gas Lease Agreement Update

TRICOUNTY GAS LEASE GROUP UPDATE September 25, 2010

Marcellus Greetings:

Status

We have not yet submitted our acreage offering to any gas companies. More

acreage has been coming in, good news we are up to about 10,000 acres. Low natural gas

prices and geologic controversies have turned the lease market somewhat sluggish.

Conversations with a few companies are warm but not anxious; they do want to look at

our acreage. At the same time broad Marcellus success keeps growing and there are companies who stalled early but now want a position.

I will be attending the Eastern Section, American Association of Petroleum

Geologist’s (AAPG) annual conference, Kalamazoo MI, September 26-28. Hot Marcellus

topics will be covered and I will be networking, gathering intelligence and gauging views

on TriCounty geographic area’s prospects.

Geologic Questions

The core areas of mid to upper Lycoming County up through northern Sullivan,

across Bradford and into Susquehanna keep reporting ever higher numbers. The first

Wyoming County Marcellus producing well is near Mehoopany, Citrus Energy’s P&G

PG2_#1H, which in just 22 days up until June 30, 2010, produced 221,015 Mcf (thousand

cubic feet or an average of 10.046 million cubic feet per day. That is a gangbuster success and portends well for NW Wyoming County. Cheers.

The “play” is searching for its geologic and commercial boundaries. Coming

south of the P&G well, and all along a line stretching from Southern Lycoming through

upper Columbia and Luzerne and on up to mid section Wayne County, the concern is thermal maturity- did the Marcellus formation in this section “over cook” as organics were turned into hydro carbons.

As this is written, test wells are underway in the upper most portions of Columbia,

and Luzerne. Results won’t likely become public but behind the scenes results will be a

big determinant of degree of interest in leasing our group’s lands.

General Observations

- Current estimate is the Marcellus is now producing 1 BCF / day - huge achievement in

such a short time. Range Resources believes several years out they will be producing 2-3

BCF / day, similar in BTU content to Arco’s Prudhoe bay peak. For perspective, the US

uses about 60 BCF/ day.

- SW and NE PA are in full exploitation and development mode. Other areas are

searching for viable geologic boundaries. Risk along the southern edge of the SW to NE

band is maturity. Risk along the northern SW to NE line is pressure / depth.

- The Eagleford is touted as a big competitor, and it is, more gas liquids, which add incremental value. But word is it is turning out less uniform than anticipated. It is much

smaller than the Marcellus as well.

- Wayne County Update. Hess and Newfield have several test wells underway.

Chesapeake and Stone wells drilled to date are believed to be no good. Parts of upper N

Wayne are still prospective, all will be known within 4-6 months.

- The Marcellus is believed to be in the top 2-3 US Gas plays economically. The further

prices sink, the sooner more marginal fields will cease drilling, a long term positive for

the Marcellus.

- Not commonly known COAL fact: today coal is the fastest growing fuel source (+5%)

year and makes up ~30% of global energy consumption, up from a low of 25% in 1999.

- Estimates of the size of the play keep adjusting; currently the industry # is 8-12 million

acres. Though it will ramp up, the % being drilled year to year is small. EVERYONE

won’t get drilled within 5, 10 or even 15 years!

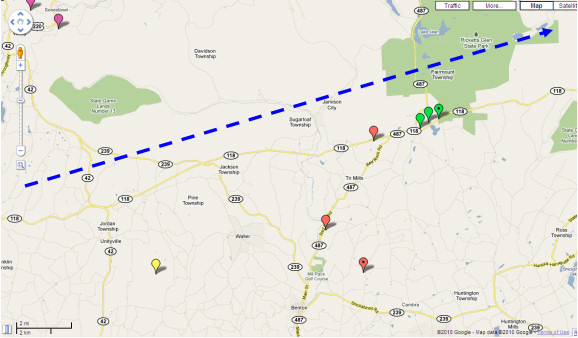

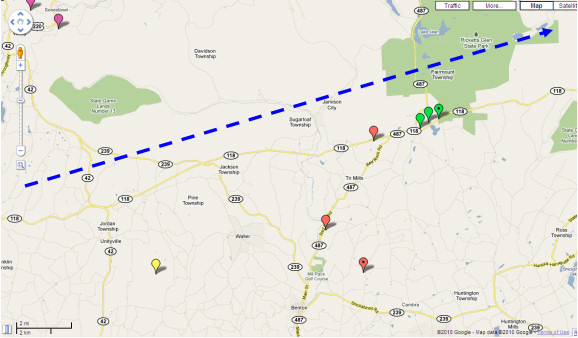

Sample of area permits: purple-Chesapeake, yellow-XTO, red-Williams, green- EnCana

Map Source: Google Dashed blue line portrays the general geologic trend axis.

We will report in after the AAPG conference and share more definitive plans.

Mr. Frederick

Marcellus Resource Lease / Analyst Consultant

Marcellus Greetings:

Status

We have not yet submitted our acreage offering to any gas companies. More

acreage has been coming in, good news we are up to about 10,000 acres. Low natural gas

prices and geologic controversies have turned the lease market somewhat sluggish.

Conversations with a few companies are warm but not anxious; they do want to look at

our acreage. At the same time broad Marcellus success keeps growing and there are companies who stalled early but now want a position.

I will be attending the Eastern Section, American Association of Petroleum

Geologist’s (AAPG) annual conference, Kalamazoo MI, September 26-28. Hot Marcellus

topics will be covered and I will be networking, gathering intelligence and gauging views

on TriCounty geographic area’s prospects.

Geologic Questions

The core areas of mid to upper Lycoming County up through northern Sullivan,

across Bradford and into Susquehanna keep reporting ever higher numbers. The first

Wyoming County Marcellus producing well is near Mehoopany, Citrus Energy’s P&G

PG2_#1H, which in just 22 days up until June 30, 2010, produced 221,015 Mcf (thousand

cubic feet or an average of 10.046 million cubic feet per day. That is a gangbuster success and portends well for NW Wyoming County. Cheers.

The “play” is searching for its geologic and commercial boundaries. Coming

south of the P&G well, and all along a line stretching from Southern Lycoming through

upper Columbia and Luzerne and on up to mid section Wayne County, the concern is thermal maturity- did the Marcellus formation in this section “over cook” as organics were turned into hydro carbons.

As this is written, test wells are underway in the upper most portions of Columbia,

and Luzerne. Results won’t likely become public but behind the scenes results will be a

big determinant of degree of interest in leasing our group’s lands.

General Observations

- Current estimate is the Marcellus is now producing 1 BCF / day - huge achievement in

such a short time. Range Resources believes several years out they will be producing 2-3

BCF / day, similar in BTU content to Arco’s Prudhoe bay peak. For perspective, the US

uses about 60 BCF/ day.

- SW and NE PA are in full exploitation and development mode. Other areas are

searching for viable geologic boundaries. Risk along the southern edge of the SW to NE

band is maturity. Risk along the northern SW to NE line is pressure / depth.

- The Eagleford is touted as a big competitor, and it is, more gas liquids, which add incremental value. But word is it is turning out less uniform than anticipated. It is much

smaller than the Marcellus as well.

- Wayne County Update. Hess and Newfield have several test wells underway.

Chesapeake and Stone wells drilled to date are believed to be no good. Parts of upper N

Wayne are still prospective, all will be known within 4-6 months.

- The Marcellus is believed to be in the top 2-3 US Gas plays economically. The further

prices sink, the sooner more marginal fields will cease drilling, a long term positive for

the Marcellus.

- Not commonly known COAL fact: today coal is the fastest growing fuel source (+5%)

year and makes up ~30% of global energy consumption, up from a low of 25% in 1999.

- Estimates of the size of the play keep adjusting; currently the industry # is 8-12 million

acres. Though it will ramp up, the % being drilled year to year is small. EVERYONE

won’t get drilled within 5, 10 or even 15 years!

Sample of area permits: purple-Chesapeake, yellow-XTO, red-Williams, green- EnCana

Map Source: Google Dashed blue line portrays the general geologic trend axis.

We will report in after the AAPG conference and share more definitive plans.

Mr. Frederick

Marcellus Resource Lease / Analyst Consultant

- Admin

- Site Admin

- Posts: 22

- Joined: Mon Apr 05, 2004 2:03 pm

Re: Gas Lease Agreement Update

Update 12-7-10: From Mr. Frederick

The preliminary inquiry of interest for the approximate 12,000 acres in the Tri-County Lease Group has been submitted to seventeen publicly traded and/or private oil and gas operators with interest in NE PA Marcellus.

Those potential lessees indicating further interest will be asked to sign confidentially agreements and then will be given detailed parcel and lease expectation information.

The good news out there is overall the Marcellus is speeding to ever greater success. The only negative is weak natural gas prices. Historically weak commodity prices are self curing.

Good luck to us all.

The preliminary inquiry of interest for the approximate 12,000 acres in the Tri-County Lease Group has been submitted to seventeen publicly traded and/or private oil and gas operators with interest in NE PA Marcellus.

Those potential lessees indicating further interest will be asked to sign confidentially agreements and then will be given detailed parcel and lease expectation information.

The good news out there is overall the Marcellus is speeding to ever greater success. The only negative is weak natural gas prices. Historically weak commodity prices are self curing.

Good luck to us all.

- Admin

- Site Admin

- Posts: 22

- Joined: Mon Apr 05, 2004 2:03 pm

Re: Gas Lease Agreement Update

None of the gas companies were interested in leasing land at this time.

See the first post at the top of this page.

See the first post at the top of this page.

- Admin

- Site Admin

- Posts: 22

- Joined: Mon Apr 05, 2004 2:03 pm

5 posts

• Page 1 of 1

Who is online

Users browsing this forum: No registered users and 1 guest